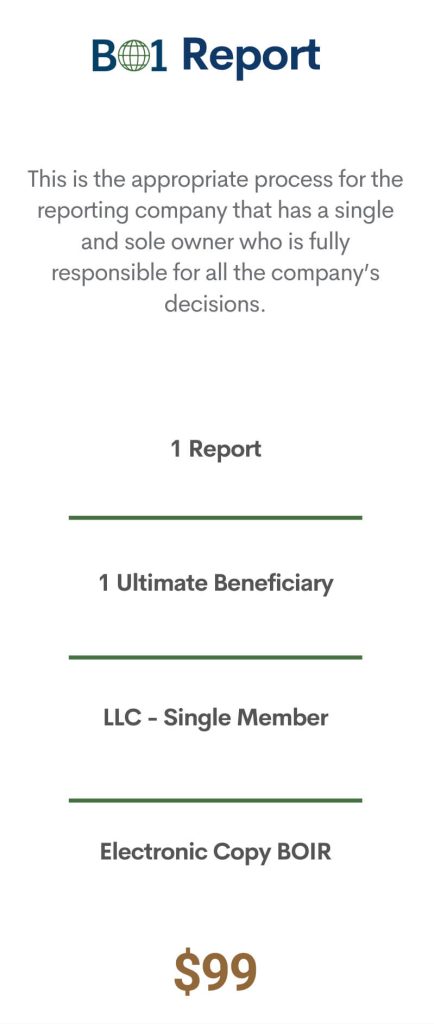

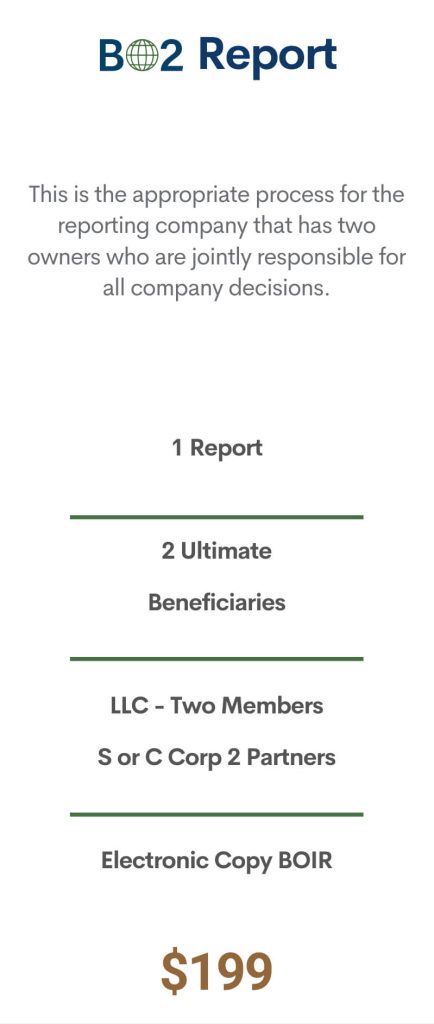

Leading Organization in Alabama Partners with LLC & Corp Compliance to Prepare BOI Reports for the Hispanic, Latino and Immigrant Business Community!

Manage BOI Report Español Leading Organization in Alabama Partners with LLC & Corp Compliance to Prepare BOI Reports for the Hispanic, Latino and Immigrant Business